Even though sometimes you feel like you’d rather just put your cash under your pillow, the vast majority of us in Europe have a bank account. But the money we put in our accounts isn’t just idly sitting there. It’s “working”, as they say. And unfortunately, quite often, that work is being done in ways that would probably weigh pretty heavy on our conscience. Speculating with commodities and pushing up global food prices, investments in the arms and coal industries – things that in other areas of our life we would object to. So why do we make an exception when it comes to our bank accounts?

Because we don’t directly see it happening? Possibly. But the same goes for other products that we use too, but we still sometimes do reject the “bad” choice and go for a more sustainable option. Because the financial system seems so incredibly complicated and opaque to us normal folk? Perhaps. Or because there aren’t so many banks offering green alternatives? That’s certainly another factor. But a new financial service provider has just joined the (pretty thin) ranks of sustainable banks – Tomorrow.

Tomorrow revealed its idea for a mobile, sustainable current account earlier this year. Until the account is ready to go, you can sign up to a waiting list on their website. Because all of the banking will be done via an app, you’ll need a smartphone to open an account. But since the basic account is set to be free of charge, that’s pretty much all you will need. This should give as many people as possible the opportunity to join Tomorrow. Each account holder will receive a Mastercard and five withdrawals per month are free of charge.

Later down the line there is set to be a premium version of the account too, where customers pay a monthly basic fee, but also receive more services.

What Does Sustainable Investment Mean?

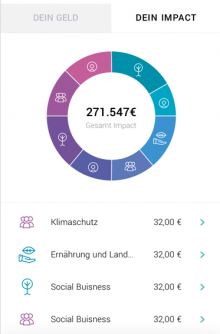

But what does “sustainable” mean exactly when talking about a current account? Well, Tomorrow has drawn up a “negative criteria catalogue” for things that they won’t be investing in, ranging from weapons and arms companies to nuclear and coal-fired power plants, to fracking, industrial animal farming and food speculation. Instead, they’ll be supporting renewable energies, organic agriculture and microcredit projects. An “Impact Board” will enable customers to see how much is being invested in different ecological and social projects. Transparency and participation are other key elements in Tomorrow’s master plan, and are things that set them apart from other fintech companies out there. You can even take a look at the young company’s plans for the future via an open Trello page (called Maschinenraum, “machine room”) that can be accessed by the public. The idea is for the general public to be get involved in the discussion and see how things are shaping up.

©

© The founders of Tomorrow are familiar faces: Inas Nureldin, Michael Schweikart and Jakob Berndt. Nureldin is co-founder of Muddy Boots, supply chain software which helps make food industry supply chains more transparent. Schweikart already helped set up the platform jobs4refugees, and Berndt is known as the founder of the social business Lemonaid & ChariTea. All of them have experience with social and ecological businesses, but none of them has a background in banking. (Maybe a good basis for thinking a little out-of-the-box?) The banking licence they need is being supplied by the Berlin company solarisBank, which supplies young businesses with the ability to offer financial services.

So far, they have developed just the current account and the accompanying Mastercard, but even here the positive impact is clear. The credit card transaction costs incurred by sellers aren’t transferred to the bank as a source of income (as they usually are), but instead they’re invested in environmental projects, such as reforestation campaigns, for example.

What’s Next?

In the long run, Tomorrow wants to offer more than just a current account. They plan to offer the full range of financial options with positive impact in the future from insurance, crowdfunding and savings plans to sustainable investment funds.

We know that sustainability pays off. Now our bank accounts can too.

This is a translation by Marisa Pettit of an article which first appeared on RESET’s German-language site.